Sarjapur Road's Real Estate Boom: How Bengaluru's new land acquisitions shaping the nest residential wave?

Sarjapur Road’s Next Big Leap (2025 Edition):

How land acquisitions are shaping Bengaluru’s real estate future?

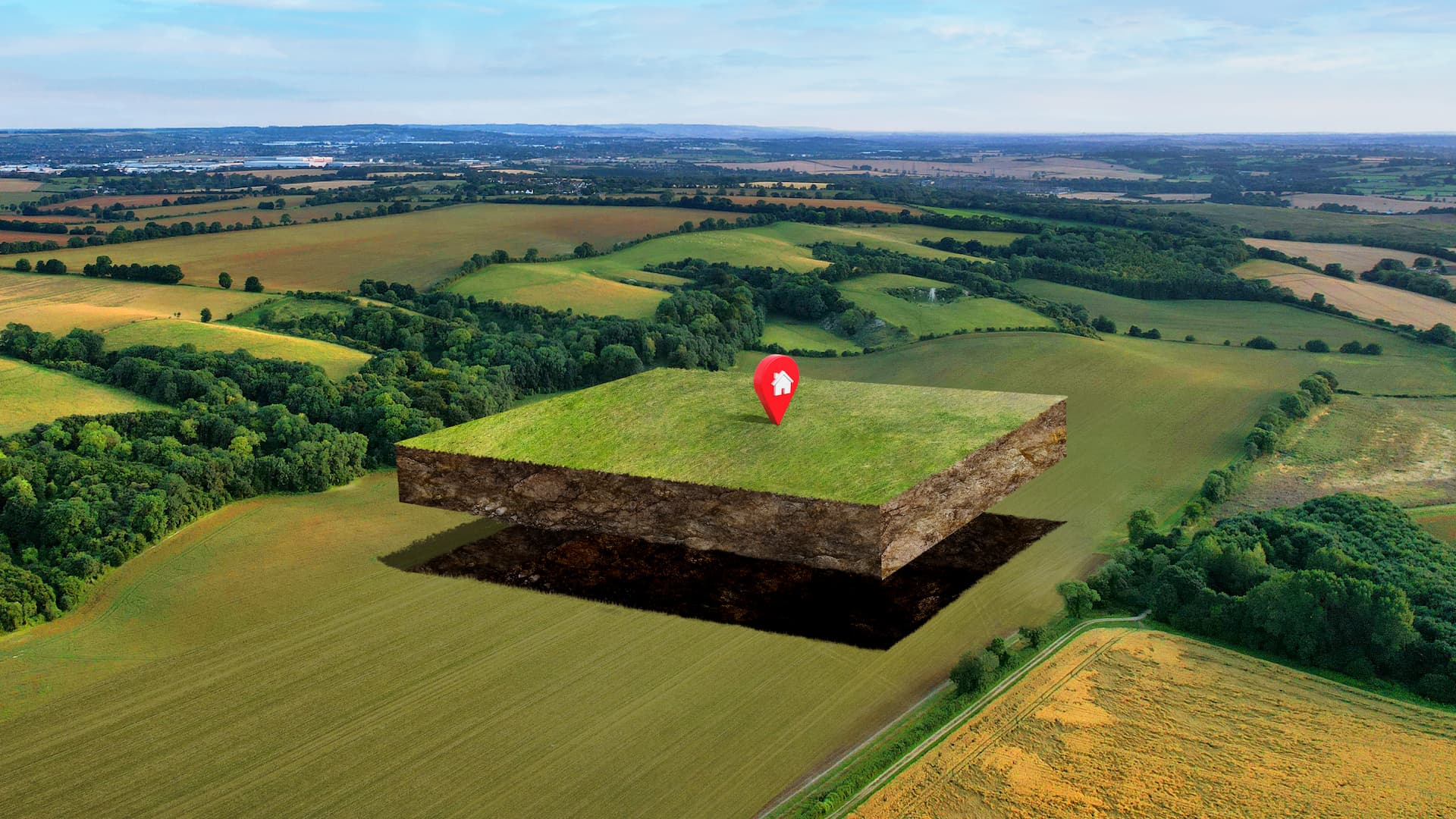

The new wave of Bengaluru’s urban expansion

Bengaluru’s real estate map is expanding once again, this time, with Sarjapur

Road at the epicenter of the city’s next housing boom.

In 2025, multiple large-scale land acquisitions by reputed developers have

redrawn the southern city’s growth corridors. The 26-acre parcel recently

acquired near Sarjapur

Road, with an estimated development potential of over ₹1,100 crore, is just

one among several signals that the area is entering a new phase of

transformation.

What was once a peripheral IT stretch has now evolved into a self-sustaining

urban ecosystem; one that blends strong housing demand, infrastructure

momentum, and investor confidence. For real estate investors, Sarjapur

Road and its surroundings represent a story of strategic foresight, backed

by numbers and rapid urban evolution.

1. The macro picture: Bengaluru’s expanding residential frontier

Bengaluru has long held its position as India’s most resilient housing market.

Despite cyclical fluctuations, the city consistently demonstrates steady

absorption rates, strong end-user demand, and healthy developer participation.

As of Q2 2025, residential launches in Bengaluru have grown by 18%

year-on-year, while unsold inventory levels remain healthy, showing a market

absorption rate of nearly 50%, according to our (JLL India) latest data.

Fig 1. Bengaluru’s residential market snapshot (Q2 2025)

2. Why is Sarjapur Road on every investor’s radar?

Sarjapur

Road’s journey from a quiet periphery to a prime corridor is one of the

most remarkable urban stories of the last decade. Its rise has been fueled by a

perfect confluence of infrastructure, IT employment, and livability factors.

2.1 Strategic location advantage

Sarjapur

Road lies at a unique junction connecting major IT clusters, Whitefield,

Outer Ring Road (Bellandur,

Marathahalli),

and Electronic

City. This triangulation makes it one of the few corridors with direct

access to three employment zones.

The Outer

Ring Road-Sarjapur link and the upcoming Peripheral Ring Road (PRR) have

further strengthened this connectivity, reducing travel time to key workplaces

and tech parks.

2.2 IT-led housing demand

The area continues to benefit from corporate relocations and new tech

establishments. Companies like Infosys, Wipro, and RGA Tech Park have expanded

their footprints, ensuring a steady inflow of mid-to-senior-level professionals

seeking quality housing nearby.

According to a Market Research report, over 60% of homebuyers in this corridor

are IT professionals, many purchasing for end-use rather than speculation, a

healthy sign for long-term market stability.

2.3 Infrastructure upgrades

The upcoming Metro Phase II (Blue Line) connecting Central Silk Board to

Carmelaram is expected to dramatically boost accessibility by 2026.

Additionally, civic works like Sarjapur

Main Road widening, improved drainage, and better power distribution have

made the corridor more livable.

2.4 Pricing and appreciation

Average property prices along Sarjapur

Road now hover around ₹9,000 to ₹12,000 per sq. ft., depending on proximity

to key junctions and developer brand. This marks a 25 to 30% increase since

2021, driven by both demand and quality supply.

Fig 2. Price appreciation (2020 to 2025)

3. The significance of large land acquisitions

When institutional developers acquire large tracts of land, as seen near Sarjapur

Road recently; it signals two key shifts in the market:

3.1 Long-term confidence in demand

Developers typically buy land with a 7 to 10 years planning horizon. Such

large-scale purchases indicate strong conviction in the corridor’s ability to

absorb premium and mid-segment housing over time.

3.2 Price stabilization and organized development

As branded developers enter the market, the nature of supply shifts from

fragmented, small-scale projects to integrated townships. This helps stabilize

pricing, bring uniformity in construction quality, and raise overall market

credibility.

3.3 Infrastructure catalysis

Large developments often attract government attention and private investments

in surrounding infrastructure. Access roads, drainage, and even metro

extensions often gain traction once anchor projects are announced.

3.4 Investor signaling

Institutional moves serve as a green flag for smaller investors. When a reputed

developer acquires land in a corridor, it reassures the market about the area’s

growth potential.

4. The new Sarjapur micro-markets: Beyond the main road

Interestingly, the growth wave isn’t confined to Sarjapur

Main Road alone. Developers and investors are eyeing emerging micro-pockets

that offer a mix of affordability and accessibility.

Fig 3. Key emerging sub-markets

These pockets are benefiting from spillover demand from saturated zones like Bellandur

and HSR

Layout. Early investors in these areas have already seen appreciation

between 18 to 25% over the last 24 months.

5. The investment lens: What makes Sarjapur Road appealing in 2025?

Let’s evaluate Sarjapur

Road through the three core lenses every real estate investor uses returns,

liquidity, and risk.

5.1 Returns

• Capital appreciation: Average CAGR of 8 to10% over the last five

years.

• Rental yield: 3.5 to 4% (among the highest in Bengaluru).

• ROI potential: With integrated developments coming up, returns could

rise to 12 to 14% CAGR in premium sub-markets.

5.2 Liquidity

• High absorption rates indicate easy resale potential.

• Developer-backed projects are usually RERA-compliant, ensuring legal

transparency and smoother transactions.

5.3 Risk

• Infrastructure delay remains a concern.

• Traffic congestion at peak hours continues to affect livability.

• Over-supply risk is limited but possible if multiple projects launch

simultaneously in 2026-27.

Investor Verdict: Balanced. Moderate risk, high long-term returns.

6. Premium housing on the rise

The narrative around Bengaluru real estate is clearly shifting from “affordable

housing” to premium and lifestyle-driven developments. The Sarjapur

stretch reflects this perfectly.

Developers are moving towards low-density, amenity-rich communities with green

spaces, co-working zones, electric charging infrastructure, and sustainability

certifications.

As a result, the mid-to-premium

price segment (₹1.5 to 3 crore bracket) now constitutes over 65% of new

launches in this corridor.

Fig 4. Segment-wise Share (2025)

This is a sharp contrast to 2019, when affordable

housing dominated the market mix with 55% share.

7. Bengaluru’s infrastructure pipeline: Reinforcing investor confidence

Sarjapur

Road’s success is not isolated. It’s part of a broader infrastructure push

that’s reshaping southern Bengaluru.

Fig 5. Key upcoming projects

Each of these projects improves access, reduces travel time, and enhances

property desirability, directly translating into price appreciation for early

investors.

8. Developer activity & market confidence

Over the past 24 months, nearly every leading developer Prestige,

Sobha,

Brigade,

Godrej,

and Shriram

has either launched or announced projects within a 10 km radius of Sarjapur

Road.

Some eminent participation snapshot that reiterates developers’ confidence in

the sub-market:

• Prestige

Group has approximate land area of 30 acres with an earning

potential of ₹1,200Cr

• Sobha

Ltd. has approximate land area

of 22 acres with an earning potential of ₹950Cr

• Brigade

Group has approximate land area of 18 acres with an earning

potential of ₹800Cr

• Godrej

Properties has approximate land area of 26 acres with an earning

potential of ₹1,100Cr

• Shriram

Properties has approximate land area of 20 acres with an earning

potential of ₹780Cr

This wave of institutional activity underlines that the corridor is entering a consolidation

phase, where large developers dominate, ensuring higher execution quality

and transparency.

9. What does this mean for investors in 2025 and beyond?

For investors evaluating Bengaluru’s next real estate hotspots, Sarjapur

Road presents a blend of stability and upside. The key lies in choosing the

right project phase and entry timing.

9.1 Investment checklist for 2025:

• Evaluate launch stage: early phases often deliver the best ROI.

• Prefer reputed developers: brand reputation reduces delivery risk.

• Check infrastructure alignment: proximity to metro, PRR junctions, or

ORR boosts resale value.

• Assess product type: mid-segment apartments and premium 3BHK units

show highest liquidity.

• Leverage long-term holding: 5 to 7 years horizon recommended for

optimal gains.

With planned metro and PRR completion timelines, investors entering in 2025 are

likely to ride the next appreciation cycle between 2026 to 2030, when

infrastructure and project deliveries converge.

The dawn of Bengaluru’s new

south

Sarjapur

Road’s transformation from a peripheral IT route into a premium residential

and investment hub represents the next evolution of Bengaluru’s urban

geography.

Large-scale land acquisitions, premium project pipelines, and accelerating

infrastructure have collectively redefined the corridor’s identity.

For investors, this is more than just another housing zone; it’s a case study

in how urban planning, private capital, and real estate confidence converge to

create long-term value.

As Bengaluru continues to expand, Sarjapur

Road stands as its southern compass pointing towards the city’s next decade

of growth, investment, and urban living excellence.

Frequently Asked Questions (FAQs)

1. Why is Sarjapur

Road gaining investor interest?

Because of its strategic location connecting major IT hubs, strong

infrastructure pipeline, and consistent price appreciation.

2. What is the average price per sq. ft. in 2025?

Between ₹9,000 to ₹12,000 per sq. ft., depending on proximity and developer

reputation.

3. What are the rental yields like?

Around 3.5 to 4%, which is among the best in Bengaluru’s premium corridors.

4. How much appreciation can investors expect in 5 years?

Historically, Sarjapur

Road has delivered 8 to 10% CAGR; future returns could be similar if

infrastructure timelines stay on track.

5. Is it better to invest in ready projects or new launches?

New launches offer better appreciation; ready units offer immediate rental

income.

6. What kind of properties dominate the area?

Mid-segment and premium apartments, with increasing interest in plotted

developments.

7. How important is metro connectivity for investment value?

Extremely important; properties within 2 km of upcoming metro stations

typically command a 10 to 15% premium.

8. Are there risks of over-supply?

Moderate but controlled since large developers plan phased launches tied to

absorption rates.

9. What is the ideal investment horizon?

Minimum 5 to 7 years for maximum capital growth.

10. Which other Bengaluru corridors are comparable?

Whitefield,

North Bengaluru (Hebbal-Yelahanka),

and Kanakapura

Road are emerging alternatives, but Sarjapur

remains the most balanced in price and growth outlook.

Source: HT article published on 15th Oct 2025 | Data & excerpts taken from JLL Bengaluru Residential Market Report, Q2 2025 | IPC reports | Developer filings & media reports | JLL Primary Research

Author & Editor: Sumedha Das

Are you a landlord?

Are you looking to lease or sell your properties? Advertising your property online with JLL is completely free. Reach hundred of thousands of potential tenants and buyers online.