JLL Talks: Webinar on Bangalore Residential Market

Note: This webinar is the first in a series aimed at empowering real estate decision-makers. Stay tuned as we dive deeper into various cities, and submarket specific trends, forecasts, and regulatory updates in upcoming episodes. JLL Homes intend to host these webinars with curated real estate insights for our viewers to make informed decisions and plan better.

Missed the live session? Watch the full webinar on our YouTube Channel!

Episode 1: Unlocking urban growth: Highlights from our latest webinar on “Bangalore’s Residential Landscape”!

As Bangalore continues to transform into a global innovation hub, the city’s residential market is witnessing dynamic shifts. To decode these changes and keep our audience updated, JLL Homes recently hosted an engaging webinar titled “Bangalore’s Residential Landscape: A Buyer’s Guide”.

The session brought together our in-house expert panel to discuss the evolving landscape, established and emerging micro markets, price indications, and trends and insights that investors and potential buyers should be aware of and look out for in 2025 and beyond.

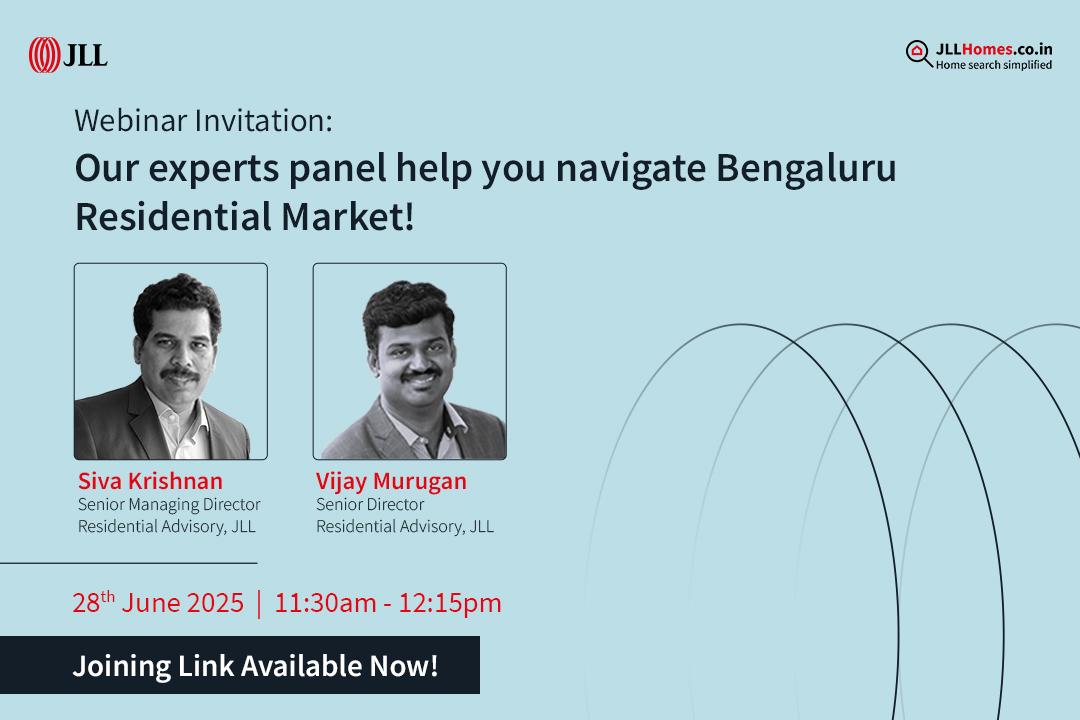

I. Our expert panel included:

1. Mr. Siva Krishnan | Senior Managing Director | Residential Advisory Services (All India)

2. Mr. Vijay Murugan | Senior Director | Residential Advisory Services (Bangalore)

II. Why did this webinar matter?

With the rapid paced growth that Bangalore is witnessing, understanding where the next wave of development is headed is crucial, not just for first-time buyers, but second users, renters, and investors. Our eminent panel threw light on 5 critical points to consider before stepping onto the next residential journey:

1. Residential Market Scenario: Deep insights into the launches and supply scenarios before, during, and after covid-19

2. Capital Value Indication: Price analysis and appreciation of residential asset class over the last 5 years

3. Inventory Overhang: A detailed understanding of how much time does it takes to consume existing inventory of residential units and whether there is any distinctive change over the last 5 years

4. Correlation between Commercial and Residential: The webinar focused on explaining the evident relationship between emerging corporate hubs and the neighboring residential units

5. Growth Corridors: The webinar focused on the top established submarkets that are currently providing the best options for buyers and top emerging markets that will be the preferred locations for potential buyers.

III. Who is it for?

Anyone! Exactly, this webinar is for anyone who is even remotely interested in understanding the real estate market. The past half-decade offers valuable clues about what lies ahead. Whether you’re planning your next development, portfolio expansion, buying a home, or policy framework, understanding the macro and micro trends is essential.

This webinar equips stakeholders with actionable intelligence and a strategic lens to navigate Bangalore’s growth cycle.

You might be:

- • A first-time home buyer

• Looking for a second home

• A seasoned investor

• A newly migrated Bangalorean

• An individual looking for rental accommodation

• Developer

• Policy maker

• An industry veteran

• Just an enthusiast curious about the market

We have something for everyone to take away!

IV. Key takeaways

1. Market Scenario:

• The onset of covid in the year 2020 did stall the momentum in all industries. With the entire nation caged into their houses, the idea of exploring any products or services, unless urgent, was avoided. However, this stagnation wasn’t a long-term story for the real estate sector. The main reason for this upsurge is the rising urge for homeownership in the market. With the dynamicity in the market clubbed with the onset of hybrid work arrangements, individuals and families aimed at owning their own houses.

• Both launches and sales witnessed an upsurge with residential sales growing by 117% in the last 5 years.

• Developers tapped this opportunity and observed the positive market sentiment and didn’t deter from launching projects.

• The type of development, however, witnessed a glow up. Developers focused on bringing holistic projects with a large spread of recreational facilities within the premises. The concept of having “1/2” bedroom became prevalent. These extra spaces were promoted as ideal work-from-home spaces.

Figure 1. Pan India Launches & Sales in past 5 years.

• Bangalore was no less in this race. The market sentiment picked up at a fast pace. With emergence of corporate and IT/Ites hubs, and Bangalore earning the title of Silicon Valley of India, the city witnessed an enormous migrant population influx.

• Total sales in Bangalore multiplied 6 times between 2020 and Q42024. 2024 witnessed sales of 69136 units.

• Launches were no less in the race. The city witnessed a multiple variant of launches over these years with 2024 witnessing launch of 57000+ units.

Figure 2.Bangalore Launches & Sales in past 5 years

2. Capital Value Appreciation:

A focused Q4 yearly analysis between 2019 and 2024 shows persistent and steady growth.

• Cities like Bangalore, Delhi NCR, and Hyderabad witnessed a 54%, 50%, and 49% price appreciation respectively. These 3 cities had a dedicated infrastructure development with excellent connectivity and social life measures

• Following them, cities like Mumbai, Pune, Chennai, and Kolkata witnessed a sober growth. These cities have comparatively more formatted market, thus these cities were a little behind than the other three.

Figure 3. Pan India capital appreciation in the top 7 metro cities.

• Bangalore has broken all these records in the last 4 years. Bangalore has witnessed a character level change in the residential market due to a huge surge in demand.

• It has become a Quasi market; a mix of end users and investors contributing to the demand. In this period, new locations evolved like Bagalur, Devanahalli, Doddaballapur, Soukiya road etc., segments like plots and villas got renewed interest among buyers

• Even we could see change in buyers’ behavior - there is a complete shift of choice to 3 BHK over 2 BHK.

• Between 2020 and 2024, in a span of 5 years, the housing sales increased by 6-folds, supply got tripled, price increased in certain localities in Bangalore to as high as 120%. The market has been constantly giving returns of about 5 to 6% year on year.

Figure 4. Average capital appreciation in Bangalore

3. What led to this surge in Bangalore?

• The growth trajectory that Bangalore witnessed began post covid. Post demonetization coupled with policy level changes like RERA & GST; the market was sluggish. The price escalation was close to nil at least for 3 full years.

• But when covid hit the market, the first assumption was the eradication of the residential market. However, covid turned out to be an unpaid promotion to emphasize the necessity for space,

- People without their own house – decided immediately to purchase

- People living in smaller spaces – decided to upgrade

- People in congested locations - moved to low density projects on the outskirts.

- Some of the Joint families – went nuclear

• Both institutional Investors and retail investors (second or third home buyers) started looking at residential investment as an opportunity.

• This trend was simultaneously boosted by the softening of interest rates enhancing affordability.

• This was well supported by strong commercial requirements. Companies started expanding and new companies started setting up their operations in Bangalore.

• For instance, 1 million sq. ft. of office space absorption is equal to 15000 new jobs creation, indicating both population and office spaces’ growth Bangalore’s office absorption has grown substantially in the last 5 years, grown 3 times from its usual size.

Other factors that added to this growth include inflation (growing rates of requisites for project development like land, materials, and labor).

The establishment of RERA regulating this industry enhanced the market faith. A strong demand, lower inventory overhang position, stable economic growth, cost of construction and cost of compliance are together contributed to the massive price increase.

4. Submarket Highlights

• In general, the East, South and Northern corridors of Bangalore were the largest contributors with as high as 90% of Bangalore’s overall sales. However, if one location stands out in terms of launches, sales, price appreciation, and economic stability, it is Whitefield.

• Whitefield includes Channa Sandra, Kadugodi, Seegehalli, Kannamangala and Varthur etc. It is a self-sufficient locality with the presence of key IT companies and best-in-class infrastructure.

• This location also enjoys the spill over from Bellandur outer ring road which has the highest number of corporates in Bangalore. Whitefield is a well sorted location even with the approach to Bangalore international airport.

• Closely following are locations like Bellary Road and Hosur Road with major residential activities across the city. Bellary Road includes Yelahanka, Jakkur, Bagalur Cross, Kogilu cross, Devanahalli etc. and Hosur road includes Hosa Road, Harlur Road, Kudlu, Begur, Chandapura, Electronic City etc.

Figure 5. Average capital value appreciation in 3 top locations

Historically, Bangalore has been

a stable and safe market for years together without much of undulations. The city is backed by layers of economic

drivers like IT/Ites, manufacturing, biotechnology, R&D centres, global

corporate companies (GCC) and start-ups.

The market has been constantly giving returns of about 5 to 6% year on

year. Hence Bangalore has predominantly been an end

user market with few investors looking for a second home or safe investment perspective.

*Source: Data & excerpts taken from JLL Research Team

Author: Sumedha Das

Are you a landlord?

Are you looking to lease or sell your properties? Advertising your property online with JLL is completely free. Reach hundred of thousands of potential tenants and buyers online.